Letter from Lewis J. Grout, Chief U.S. Probation Officer, to Isaac Sway, Chief Parole Officer at the U.S. Penitentiary at Leavenworth, regarding Otto P. Higgins', Inmate #55996-L, release from the penitentiary and the requirement that he report to the probation officer in Kansas City upon his release.

Pryor, John J.

Judgment in Criminal Case No. 14652: United States vs. Matthew S. Murray, defendant. Judge Albert L.

Indictment in Criminal Case No. 14652: United States vs. Matthew S. Murray, defendant. Murray was the Director of Public Works for Kansas City, Missouri, and Missouri Administrator of the Works Progress Administration, and was charged in five counts with income tax evasion for the years 1934-1938.

U.S. Attorney Maurice M. Milligan's opening statement in Criminal Case No. 14652: United States vs. Matthew S. Murray, defendant. Milligan notes that Murray filed tax returns in each of those years, for considerably less than his actual income, i.e.

Letter from Thomas McGee to Harry S. Truman in which McGee discloses his efforts to get Pendergast and James P. Aylward to help re-appoint his son-in-law, John Lillis, to the Federal Housing Administration. McGee says that Pendergast may seek the help of Truman and Bennett C. Clark in this matter.

Letter from J. T. Montgomery to Governor Lloyd C. Stark discussing machine candidates in an upcoming election. He writes, "If I were in your place, I would tell these gentlemen that their ticket was not a Democratic ticket, but was a machine ticket in order to get control again of Kansas City, and rob its people."

Correspondence from Thomas Pendergast Jr. to Margaret Truman Daniel, likely dated after the 1973 publication of her biography about her father, Harry S. Truman. It is unclear if the note was ever delivered or if it remained in Pendergast Jr.'s possession. In it, Pendergast Jr. accuses Harry Truman and James M.

Order detailing O'Malley's probation for Criminal Case No. 14459: United States vs. Robert Emmet O'Malley, Defendant. In this document, Judge Merrill E. Otis outlines the details of O'Malley's probation followed by a memorandum that clarifies custody and parole conditions of the defendant.

Indictment for Criminal Case No. 14742: United States vs. John J. Pryor, Defendant. In this indictment, the defendant is charged with income tax fraud for the calendar years 1934 through 1937. Pryor, co-owner of Boyle-Pryor Construction Company, reported $12,000 in gross income in 1934 while the true figure was $206,487.05.

Verdict and Commitment for Criminal Case No. 14742: United States vs. John J. Pryor, Defendant. Upon plea of guilty for three counts of income tax fraud, Pryor is sentenced to federal penitentiary for a total of two years with five years probation following. Pryor is also fined a total of $20,000.

Treasury Department parole report for John J. Pryor, Inmate #56309, forwarded by W. H. Woolf, the Intelligence Unit acting chief. The report summarizes the case against Pryor and discusses ways in which he was or was not cooperative in the investigation. Pryor was sentenced to two years in the U.S.

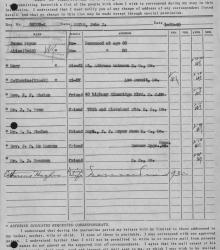

List of relatives and requested correspondents for John J. Pryor, Inmate #56309, which includes the names and mailing addresses of his parents, wife, and other friends and family. Pryor was sentenced to two years in the U.S. Penitentiary at Leavenworth for tax evasion.